2024 State of the Industry Report

The U.S. economy did better than expected in 2023, avoiding a recession that many experts predicted. Inflation fell, jobs increased and manufacturing investments spiked. But if there’s a theme for 2024 it might be uncertainty due to several factors, including higher interest rates, sluggish global supply chain restructuring, and wars and political uncertainty throughout the world.

In this year’s State of the Industry report – one of Composites Manufacturing magazine’s most anticipated articles each year – four experts provide insight on markets and materials to help guide composites companies through the uncertainty.

The Automotive Market

By Marc Benevento, President

Industrial Market Insight

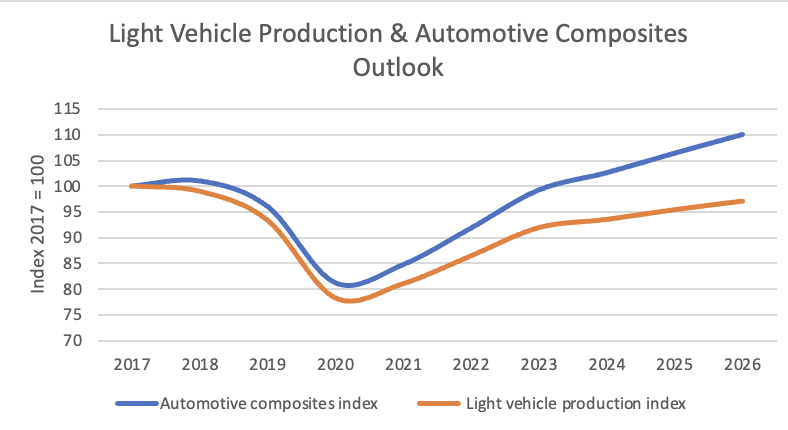

Last year brought continued recovery to the automobile supply chain, with global vehicle production improving by 6% year-over-year and returning to near pre-pandemic levels. Demand for automotive composites outpaced vehicle production, as composites continued to win applications and increase their share of vehicle composition. Weight reduction will continue to be of paramount importance in improving the fuel efficiency of internal combustion engines (ICE) and hybrid vehicles, while also helping to maximize the range of battery electric vehicles (BEVs). Composite materials promise to deliver new applications that will drive above-market growth in the years to come.

The global market for light vehicle composite materials grew to nearly 4.4 billion pounds in 2023, roughly on par with the pre-pandemic peak in 2018. Although global light vehicle production remains 8% below pre-pandemic levels, the more rapid recovery of light vehicle composite volume can be attributed to a gain in market share versus competing materials such as steel and aluminum.

In 2023, light vehicle production growth was uneven regionally, with Europe well above the global average growth rate, China well below average and other major regions generally aligned with the global average of 6% growth. With global supply now relatively aligned with demand, vehicle production growth will flatten, and suppliers will lose the tailwind they have enjoyed for the past few years. The outlook for light vehicle production growth over the next few years is less than 2% per year, making volume growth more difficult for suppliers to achieve. However, the adoption of composite materials is occurring at an accelerating pace which will help counter that trend.

The automobile industry remains in a transitional state, with BEVs rapidly gaining market share due to government incentives and global efforts to reduce greenhouse gas emissions. However, ICE and hybrids still account for 80% of global vehicle sales. China is leading the BEV charge, accounting for almost 60% of global BEV sales, and Europe adds another 20%. Although BEV sales have reached record levels in the United States, mainstream consumers are more frequently opting for hybrid vehicles, which offer improved fuel economy without the range anxiety associated with reliance on the developing EV charging network. North America will continue to lag in the global adoption of BEVs.

The good news for suppliers of automotive composites is that, regardless of powertrain type –BEV, hybrid or ICE – OEMs are aggressively pursuing weight reduction to improve fuel economy or increase the range of BEVs. The need for weight reduction has resulted in above-market growth for both thermoplastic and thermoset composites. Applications such as liftgates and seat frames, which take advantage of the design flexibility that composites offer to eliminate parts and streamline manufacturing while reducing weight, can also add new or improved function for users. The multi-functional benefits offered by composites will accelerate their use in light vehicles over the next decade.

With the global automotive supply chain largely back to normal, light vehicle production has recovered to pre-pandemic levels and production growth will flatten in the near-term future. However, composites will deliver above-market growth by winning new applications due to their ability to reduce vehicle weight, minimize complexity and deliver unique packing and function to end users when properly incorporated into light vehicle design.

Figure 1: Light Vehicle Production & Automotive Composites Outlook

Source: Industrial Market Insight

The Glass Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

Last year, the overall glass fiber market sentiment remained cautious, underscoring persistent economic uncertainties in the U.S. The looming prospect of a recession added complexity, with potential consequences including workforce layoffs and increased challenges in the housing and other markets. Broader economic factors, such as inflation, interest rates and discretionary spending, are also influencing demand for products such as boats and recreational vehicles. In addition, the recent increase in interest rates has softened discretionary spending, directly impacting home sales and construction demand.

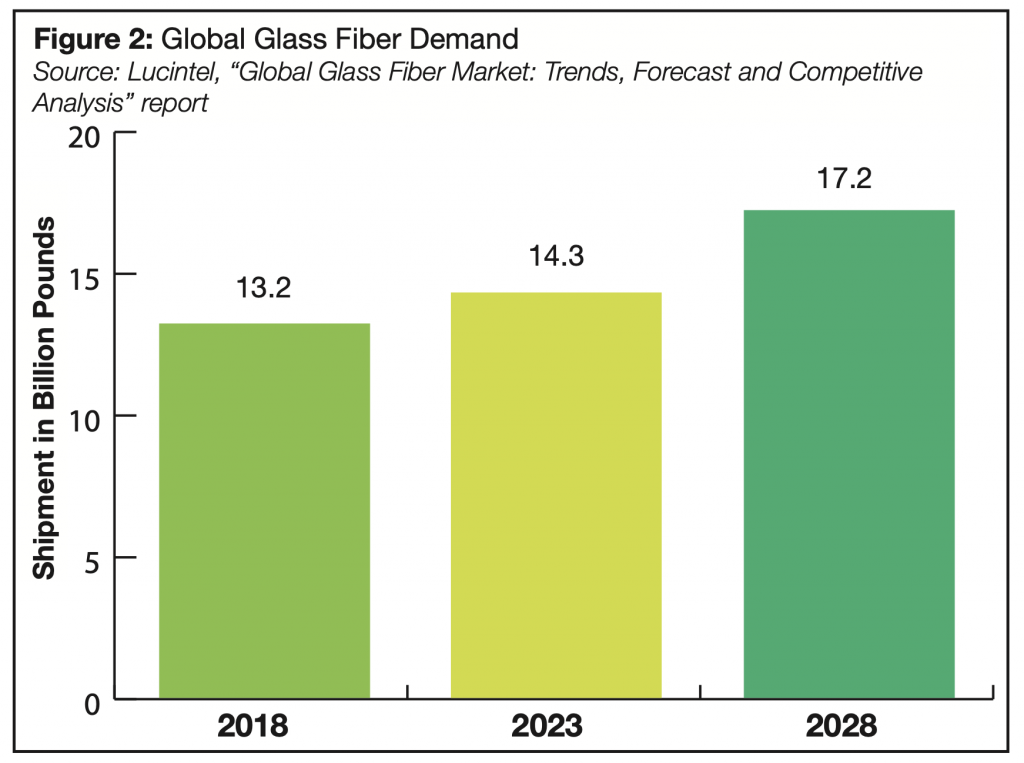

Overall, demand in the glass fiber market reached 14.3 billion pounds in volume in 2023. The future seems to hinge on navigating these complex market dynamics and adapting to the shifting economic landscape.

There is a possibility of interest rate cuts in Q1 or Q2 2024 in the U.S., which will positively impact investment and consumer behavior. Lucintel forecasts that glass fiber demand will increase by approximately 4% at a compound annual growth rate (CAGR) in terms of volume from 2023 to 2028 as shown in Figure 2.

One of the major challenges that plagued the composites industry in 2021 and 2022 was increasing raw materials prices due to supply chain issues, geopolitical events and the war in Ukraine. Resin and fiber prices declined in 2023 due to softening of the economy.

In the future, demand for glass fiber will remain robust, with increasing demand in wind energy, electrical and electronics, automotive, marine and construction. According to the U.S. Department of Energy (DOE), wind energy accounted for 22% of all new electricity capacity installed in the United States in 2022. Wind energy is poised for rapid growth, attracting $12 billion in capital investment in 2022, according to the DOE. The forecasts for land-based wind energy installed in 2026 will increase nearly 60% from approximately 11,500 megawatts (MW) to 18,000 MW in the U.S. since the Inflation Reduction Act passed. This will drive consumption of glass fiber composites in the U.S.

As environmental consciousness grows, the glass fiber market's shift toward sustainability is a win for consumers who prioritize eco-friendly choices. Recyclable and low-impact glass fiber products contribute to a greener future. However, big questions loom over how to handle the waste these materials create. For instance, while most parts in wind turbines are recyclable, turbine blades present a challenge – the bigger the blades, the bigger the problem of waste management.

The sustainable solution seems to be using recycled material and recycling waste. Major OEMs are collaborating with partners to experiment with recycling processes. For example,

GE produced the world’s first prototype of a fully recyclable wind turbine blade, a new step toward the industry’s transition to a circular economy under the Zero Waste Blade Research (ZEBRA) consortium, which includes Arkema, CANOE, Engie, LM Wind Power, Owens Corning and SUEZ. The 62-meter blade is made with Arkema’s 100% recyclable Elium® liquid thermoplastic resin and high-performance glass fabrics from Owens Corning.

Several glass fiber suppliers also have an eye on sustainability. China Jushi plans to invest $812 million to build the world's first zero-carbon glass fiber plant in Huai'an, China. Toray Industries developed a technology to recycle glass fiber-reinforced polyphenylene sulfide (GFRP-PPS) that performs like virgin resins. The company leverages a proprietary compounding technology to blend PPS resin with special reinforcing fibers.

Overall, the glass fiber market is undergoing a remarkable transformation, driven by growth, innovation and a heightened awareness of sustainability. The global glass fiber industry is expected to grow in the coming years. Key factors driving growth include increased demand from emerging economies, further adoption in transportation and construction sectors, and new applications in emerging industries.

Figure 2: Global Glass Fiber Demand

Source: Lucintel, “Global Glass Fiber Market: Trends, Forecast and Competitive Analysis” report

The Aerospace Market

By Richard Aboulafia, Managing Director

AeroDynamic Advisory

Much of the world economy is facing a highly unusual situation. For the first time since the 1960s, the defining problem is not inadequate demand, but inadequate supply. Whether it’s cars, houses or aircraft, output is increasingly determined by production limitations.

This is particularly true for aviation. Demand is strong enough to justify faster growth, but supply chain delays, final assembly line stumbles and other production problems are suppressing output.

First, on the demand side, the Russia-Ukraine war, tensions in the Western Pacific and the Israel-Hamas war have pushed defense spending into record territory. The U.S. has been spending at record levels for years. In fiscal 2024, the defense budget request includes $315 billion for weapons investment, including procurement, as well as research and development.

On the civil side of the industry, air travel demand has almost completely recovered from the COVID-19 pandemic. Demand for new jetliners remains quite strong. Backlogs are near record highs, and the ratio of new orders to completed sales has been above 1:1 for two years. Business jet demand is also strong, correlating with robust corporate profits, equities markets and oil prices.

Yet despite these powerful market drivers, aircraft industry output remains feeble. Military output is flat, although much of that is due to a deliveries hiatus for the Lockheed Martin F-35 Joint Strike Fighter, the world’s largest defense program. Civil output grew approximately 20% last year, but much of the growth came from delayed deliveries of jets built in previous years – Boeing 737 MAXs and 787 Dreamliners. In all, aircraft production, net of already-built jets, was anticipated to grow less than 10% in 2023.

How long will this unusual situation continue, with demand strongly outpacing supply? On the defense side, it will persist for the foreseeable future. After a multi-decade, post-Cold War hiatus, global tensions are high and it’s unrealistic to think they will ameliorate. Militaries around the world are expanding and replacing old, worn-out equipment. They are also eager to adapt new technology – particularly for surveillance, reconnaissance and battlefield management – but also to rebuild depleted weapons inventories.

The commercial side is more difficult to predict. However, given that airlines and other customers are eagerly awaiting jets on back order and that travel demand drivers remain solid, it will likely be at least two to three years before we need to worry about the usual market indicators again, such as passenger traffic and airline profitability.

On the downside, there is the risk of another exogenous shock, such as another pandemic. However, there is potential upside, too: China demand growth has stumbled, but it could resume its strong historic pace.

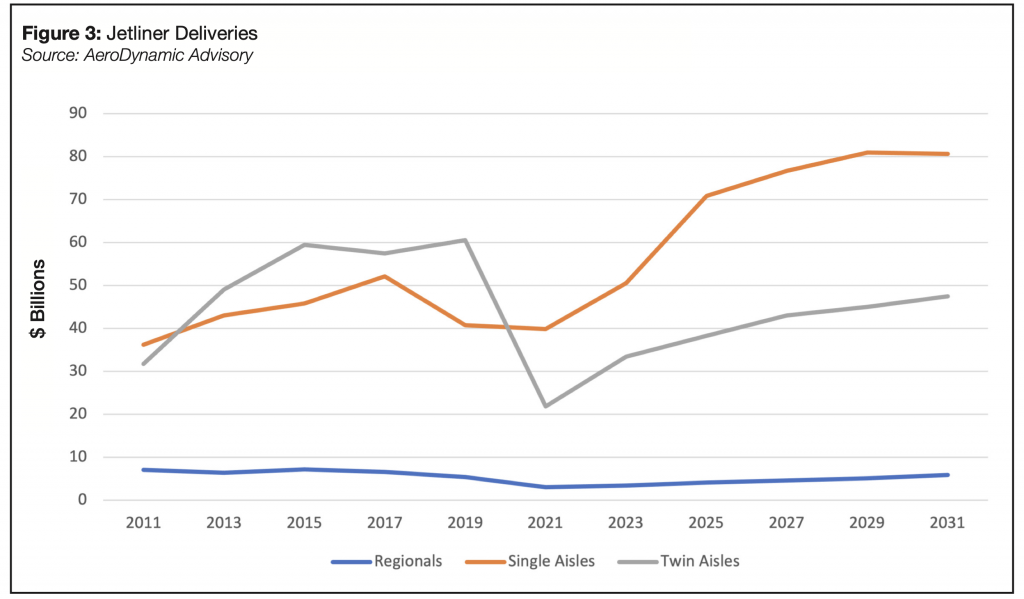

A final note on the aerospace industry’s recovery. Historically, the industry recovers from downturns at a brisk pace, burning through backlogged orders and swiftly bringing in revenue. Typical recoveries see higher annual growth rates than today’s, but they are often followed by a downturn frequently self-induced by overproduction. The silver lining is that production constraints appear likely to prevent this kind of overproduction. The industry might just have a smooth, steady decade of growth ahead.

Figure 3: Jetliner Deliveries

Source: AeroDynamic Advisory

The Carbon Fiber Market

By Dr. Sanjay Mazumdar, CEO

Lucintel

Last year was challenging for the carbon fiber industry in non-aerospace applications due to high interest rates and lower demand. The global carbon fiber industry reached 280 million pounds ($3.2 billion) in volume in 2023. However, Lucintel forecasts that demand will increase at a compound annual growth rate (CAGR) of approximately 8% in volume from 2023 to 2028 due to growth of carbon fiber in wind turbine blades, a resurgence in aircraft deliveries, light vehicle production and demand for sporting goods, recreational vehicles, and electrical and electronic products.

One area that offers significant opportunities for carbon fiber is prepreg materials. Lucintel expects the global prepreg market to reach an estimated $8.4 billion by 2030 with a CAGR of 5.5% from 2023 to 2030. Much of this growth will be driven by increased demand from the automotive, aerospace, defense and renewable energy industries.

Carbon fiber use in the aerospace industry is gaining momentum as OEMs continue to benefit from post-pandemic travel recovery. Lucintel expects carbon fiber use in the aerospace and defense market to grow at a CAGR of 7.3% from 2023 to 2030 in part due to increased demand for lightweight aircraft and expansion of aircraft with high carbon fiber penetration, such as the Boeing 787 Dreamliner, the Airbus A350XWB and the Airbus A380.

Carbon fiber manufacturers are investing in new or upgraded facilities to meet increasing demand. Toray Composite Materials expanded its facility in Decatur, Ala., with an investment of $15 million. The company allocated internal capital to double the production capacity of TORAYCA® T1100 intermediate modulus plus (IM+) carbon fiber and add critical redundancy.

In addition to traditional markets like aerospace, emerging markets also offer opportunities, including pressure vessels for hydrogen storage and the advanced air mobility market. While these markets are in their nascent stages, the potential impact on the carbon fiber supply chain cannot be understated. As these markets mature, the demand for carbon fiber is expected to grow further.

While opportunities abound, there are a few major challenges facing the carbon fiber industry. Key among them is the quest for sustainability. OEMs and Tier 1 suppliers are aggressively pushing their carbon fiber suppliers to provide sustainable carbon fiber.

Most OEMs have set targets to become carbon neutral by 2050. They have begun considering recycling as part of their design criteria for the next generation of parts manufacturing. Several carbon fiber companies are investing in bio-based PAN precursors to produce carbon fiber. Toray is working to move to a bio-based PAN precursor, while other companies, such as Hyosung, have started using bio-based PAN precursor on a trial basis.

Carbon fiber is an energy-intensive manufacturing industry. Most players are striving to decrease CO2 emissions from carbon fiber production by switching to renewable energy. Since energy cost is a sizeable portion of carbon fiber production, companies are focusing on utilizing wind and solar energy. SGL Carbon plans to utilize 100% renewable energy for carbon fiber production soon, and Zoltek has started using renewable energy in some of its plants.

Another obstacle to wider spread adoption of CFRP is the high cost of manufacturing carbon fiber. Ongoing price wars from Chinese carbon fiber manufacturers will further disrupt the market. While Chinese players are rapidly adding new capacities, there is mounting pressure on the profitability of manufacturers.

Zhongfu Shenying Carbon Fiber Co. plans to invest $866 million in a new plant in Lianyungang, China, to produce 30,000 tons of high-performance carbon fiber a year. Construction began in April 2023 and will be completed in August 2026. Lucintel anticipates that new capacity such as this will contribute to significant price competition in carbon fiber in the coming years, and the price of carbon fiber will fall in many applications.

Overall, manufacturers need to focus on innovation to reduce costs while developing new and low-cost technology to meet the industry demand and make carbon fiber more accessible.

The Construction/Infrastructure Market

By Ken Simonson, Chief Economist

Associated General Contractors of America

The construction industry, like the broader economy, escaped a recession in 2023. The outlook for 2024 remains positive overall but with some substantial swings in various sectors.

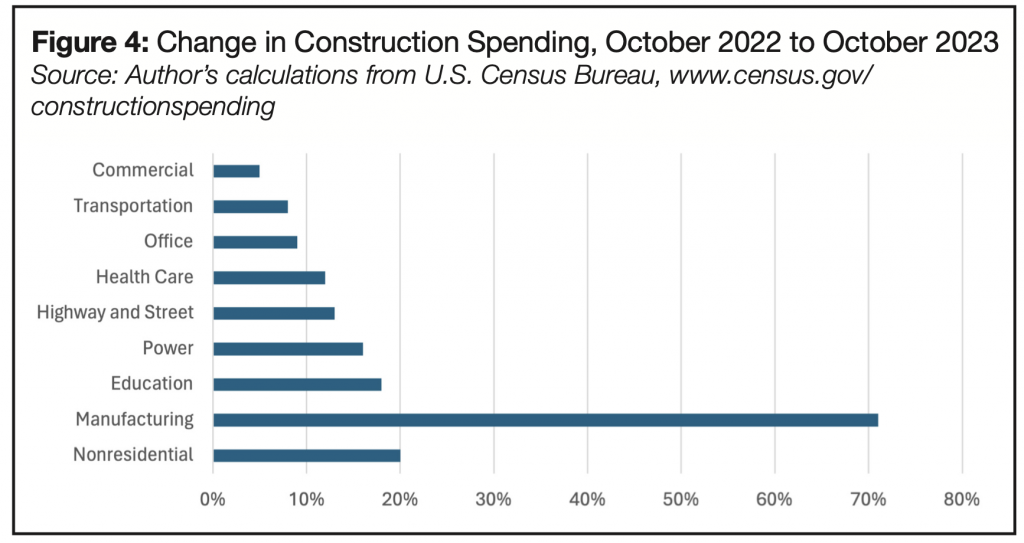

Construction spending topped $2 trillion at a seasonally adjusted annual rate (but without adjusting for inflation) by late summer 2023, according to the Census Bureau. Spending jumped nearly 11% from October 2022 to October 2023, with gains in all 16 nonresidential categories that the bureau reports on in its monthly release.

The fastest-growing category in 2023 was manufacturing construction, which jumped 71% over 12 months. The increase was led by electronics plants, such as the semiconductor fabrication facilities outside of Austin, Phoenix and Columbus, Ohio, along with more recent projects near Boise, Idaho, and Lehi, Utah. A host of electric vehicles, EV battery and component plants added to the growth spurt, despite a couple of postponements. In 2024, these segments are likely to continue increasing and be joined by numerous plants to serve the burgeoning renewable energy sector.

That sector also promises to be a growth market, with new solar, transmission and utility-scale battery storage projects. In addition, federal grants and tax credits may help launch construction for a variety of new technologies, such as alternative battery materials and carbon capture demonstration projects. These increments will offset a possible downturn in construction related to offshore wind.

Data centers remain a hot market (although, ironically and frustratingly, the Census Bureau doesn’t break out data on data center construction). Data centers are spreading to new areas as demand outstrips power supply in traditional locations such as northern Virginia. Rapid adoption of artificial intelligence is the latest driver of demand for data centers.

Infrastructure spending should finally get a boost from the Infrastructure Investment and Jobs Act. That bill became law more than two years ago but new requirements regarding U.S.-made materials, apprenticeship programs and prevailing-wage rates have slowed the awarding of contracts.

Partially offsetting these expanding segments, there are likely to be fewer warehouse and office projects. Developers are facing higher financing costs, tighter lending standards and flattening or falling rents. These unfavorable dynamics may also constrain retail and lodging construction.

As for residential construction, multifamily spending increased by 17% year-over-year in October. But the number of permits drawn for new multifamily units tumbled 28% from the previous October, implying a huge drop in apartment projects once current buildings are completed. Single-family homebuilding was down from a year earlier but by less than 2%, the smallest year-over-year decline since August 2022. In fact, single-family construction spending climbed every month since April. Thus, it appears likely that homebuilding will exceed 2023 levels, while apartment construction sags.

Contractors and owners enjoyed a respite from the soaring materials prices and delivery times that plagued construction in 2020 through mid-2022. But the holiday is not likely to last through 2024. An increase of 4% to 6% for materials costs seems possible. For the most part, the supply chain should not be a headache, with the major exception of electrical items such as switchgear and transformers. These products have had unprecedented and ever-growing lead times, and relief is not yet in sight.

For most contractors, labor availability will remain the number one headache. While job openings have slackened in the broader economy, construction employers still report record openings compared to the same month in previous years. With the construction unemployment rate down to 4% or so, it is clear that there are few jobseekers with construction experience who are currently out of a job and looking for one. Wages are likely to rise by 5% to 7%.

In short, there will still be plenty of projects in 2024 but not necessarily in the same categories as before. Materials and labor costs are both likely to climb more than in 2023.

Figure 4: Change in Construction Spending, October 2022 to October 2023

Source: Author’s calculations from U.S. Census Bureau, www.census.gov/constructionspending

SUBSCRIBE TO CM MAGAZINE

Composites Manufacturing Magazine is the official publication of the American Composites Manufacturers Association. Subscribe to get a free annual subscription to Composites Manufacturing Magazine and receive composites industry insights you can’t get anywhere else.