Faster Speed, Greater Opportunity

The 2010s were a transformative decade for composites as the industry’s focus shifted from production of small, non-structural parts made with woven fabrics to larger, structural parts made with unidirectional reinforcements. The impetus for change came from the automotive and aerospace industries. They appreciated composite materials’ unique properties – especially their light weight – and wanted to incorporate more composites into their products. But there was a stumbling block to widespread adoption; the speed of thermoset composite production wasn’t up to large-scale applications.

“They said, ‘We need to have fast manufacturing solutions,’ and that’s where thermoplastic composites come in,” says Sebastiaan Wijskamp, technical director of the ThermoPlastic Composites Research Center (TPRC) in The Netherlands. Founded 10 years ago, TPRC is a consortium of industrial and academic members whose goal is to enable a wider use of thermoplastic composites by eliminating technological barriers.

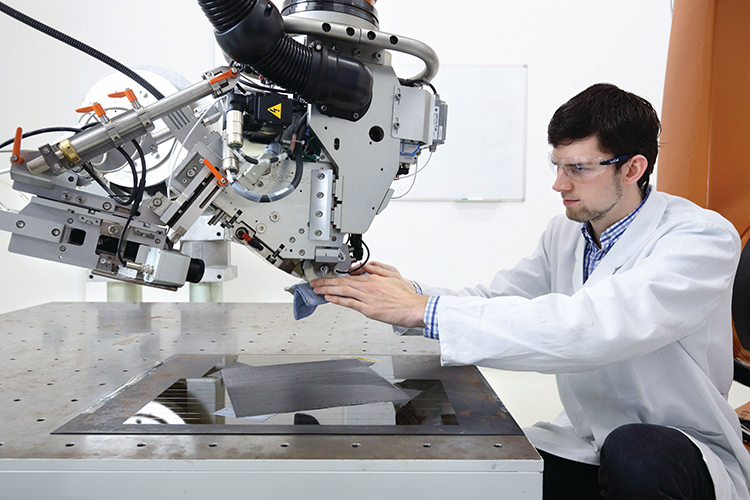

One reason for the high speed of thermoplastic composite production is its use of unidirectional tape and automated fiber placement (AFP) equipment. “You can build up a large piece, kind of like using a 3D printer, but with carbon reinforced tapes,” says Wijskamp. “If you do that well, you shouldn’t have to do an autoclave step to melt and consolidate the part under pressure. If we can stop that autoclaving step, we should be able to make big parts in a very short time.”

There are several other benefits, too. Using AFP, manufacturers can tailor parts by placing unidirectional fibers to reinforce areas that need strength and eliminating unnecessary material where it’s not required for structure. In addition, thermoplastic composite parts can be quickly joined together through processes like fusion bonding or heat welding, speeding manufacture and enabling faster repair of composite components.

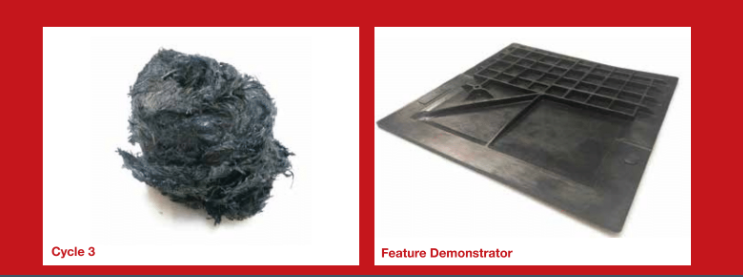

Another benefit to thermoplastic composites is their recyclability. Production scraps and no-longer-needed parts can be kept out of landfills and reused. “The nice thing is that you only have to shred the composite pieces and melt them,” says Wijskamp. “There is no pyrolysis or burning of the matrix or any chemical process involved. So it’s an energy efficient and very clean way of recycling.”

The development of new materials and equipment for thermoplastic composites is one indicator of the market’s growing interest in them. One example is the VICTREX™ AE250 product family, which includes polyaryletherketones (PAEK) and carbon-fiber based unidirectional tapes that enable faster manufacturing of thermoplastic composites while reducing their weight.

“Developing a new polymer is a big investment, and polymer manufacturers don’t usually undertake such an action before they see market potential,” says Wijskamp. “You also see it with machine builders. Ten to 15 years ago there were only some very dedicated, small companies building machines for thermoplastic composite processing. Now you see all major machine builders going into this market.”

Ongoing Research to Encourage Adoption

While thermoplastic composites offer many benefits and have come a long way in the past decade, there’s still work to be done to advance mainstream use. TPRC has been a leader in Europe’s thermoplastic composite research. Consortium members share what TPRC researchers discover in a pre-competitive environment and apply it to their own manufacturing processes.

Ongoing research at TPRC includes many aspects of thermoplastic composite production, including stamping and overmolding, fusion of thermoplastic parts and long-term performance. Researchers develop software modeling tools that can help characterize the materials, fine-tune processes and improve tool production.

Sustainability is a major focus at TPRC. As the use of thermoplastic composites increases, the industry must be prepared with solutions for production scrap and for the recycling of end-of-life products, Wijskamp says. For one project, TPRC supported GKN Aerospace in the production of compression-molded access panels manufactured from recycled thermoplastic waste material. The panels were installed and tested in Bell Helicopter’s V-280 Valor.

End Users Seek an Array of Properties

As thermoplastic composite manufacturers turn their attention to bringing larger parts to market, equipment manufacturers like Coriolis Composites are feeling the impact. In the past, the company has only built high-performance AFP machines that use ¼-inch wide tapes for the production of small, intricate thermoplastic parts. Now customers want something different. Coriolis is being asked to design and build wing and fuselage machines that use wider tapes to speed up the thermoplastic composite manufacturing process, according to Burak Uzman, the company’s general manager.

There is a tradeoff for that speed, however. Wider tapes are less steerable and do not afford the same flexibility for design optimization as narrower tapes do, Uzman says. Designing for wider tapes foregoes opportunities to have a lighter weight structure.

In addition to a move toward wider tapes, Uzman currently sees a lot of interest in in-situ consolidation of thermoplastic composite components. The challenge there is ensuring the material forms strong bonds between layers. “In thermosets we take the bond between the different layers for granted, because thermosets spend hours in the autoclave and you put the pressure on them. That gives the resin chemistry plenty of time to form those linkages,” he says. But with in-situ consolidated thermoplastic composites, getting the required interlaminate properties depends on how the AFP machine processes the laminate, and, even more important, how well the engineers that program the machine understand the processing parameters like resin chemistry.

Customers want to try thermoplastic composites for a variety of reasons, according to Uzman. In structural applications, end users want the interlaminar shear and tension strength of thermoplastic composites, which makes them a good choice for parts that try to flex under load, such as I-beams, spars, fuselage frames and some wing skins. Other customers are more interested in thermoplastics’ damage-resistance properties. They want to protect aircraft surfaces from damage when a tool is dropped, when items get shoved into cargo bays or when a passenger in high heels walks on the laminate.

“Automotive is interested in black sheet metal – they want composites that behave like steel when they form them. So we do a lot of work in the simulation of 3D shapes in the forming process,” Uzman adds. These customers are experimenting with a variety of thermoplastic manufacturing techniques. “In the automotive world, the material system has not been locked in place yet. Some favor the infusion process with epoxies, some favor thermoplastics and lamination forming, and there is some effort in the infusion of thermoplastics with low viscosity thermoplastic resins.”

Striking the Right Balance

Consulting firm Forward Engineering assists international automotive OEMs and parts manufacturers that are interested in lightweight structures and composite materials. Forward Engineering has worked primarily with thermoset composites in the past, but today its projects are split evenly between thermoset and thermoplastic composites. The company’s clients are looking at the potential of thermoplastic composite in high-volume, low-cycle-time, automated production of structural parts.

“OEM’s have a broad portfolio of materials to choose from, including lightweight metals that they are very familiar and comfortable with,” says Adam Halsband, Forward Engineering’s managing director. “For thermoplastic composites to be attractive, they must strike the right balance of mass, cost and performance.” OEMs consider design, material and manufacturing to determine the feasibility of using any product, and thermoplastic composites manufacturers have some remaining challenges to overcome there.

One is the lack of good data. To properly design structural parts, engineers need to understand thermoplastic composites’ properties so they can input that information into their modeling and simulation programs. (Halsband refers to this data as “material cards.”) Forward Engineering has been working with leading material suppliers to accelerate the development of these material cards.

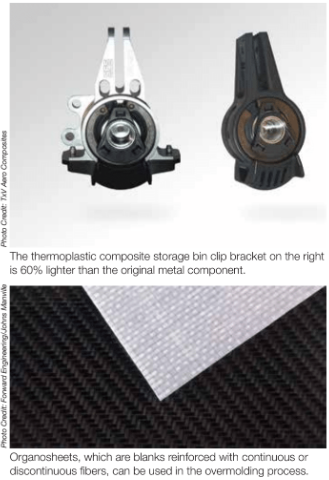

The availability of thermoplastic composites in the necessary quantities and at a competitive price is another problem. “For manufacturing, there needs to be a capable supply base,” Halsband says. Advances in automated manufacturing processes and in the high-volume production of continuous and discontinuous fiber organosheets should help address both availability and cost concerns.

Overmolding could be one way of improving production speed and enhancing the properties of a thermoplastic composite part. Manufacturers heat an organosheet, which is a reinforced composite blank, and form a part in a press. The part is then injection molded as well. This process produces thermoplastic composite parts with complex geometries and integrated assemblies.

Hybrid additive manufacturing also has the potential for increasing production speeds. In this production method, manufacturers use 3D printing to add features to a larger substrate.

“By printing features like clips or retainers onto a larger substrate you can add complex functions to a simple part without the challenges of complex injection molding tooling,” explains Halsband. “Additionally, 3D printing features onto a larger substrate allows you to relatively easily utilize different resins on the same part. In one area you may need a stiff reinforcement rib or feature to secure a mechanical fastener, while in another area you may want to use a flexible material to mold clips to secure a wiring harness.”

With hybrid additive manufacturing it’s possible to produce relatively large parts with a mix of functional features. The process would simplify production and assembly through parts consolidation and optimized packaging.

Halsband believes that case studies demonstrating structural thermoplastics’ mass cost performance benefits will drive more opportunities. “Nothing beats the validation of success,” he says. “In the meantime, leading material, process and design firms must actively engage the market and share the successful development work that is ongoing now.”

Small Steps in Aerospace

Thermoplastic composite manufacturer TxV Aero Composites, which is part of polymer provider Vitrex, and parts producer SFS Intec are working cooperatively to develop thermoplastic composite parts for the aerospace industry. They have re-engineered metal aircraft storage bin clip brackets and are using an overmolding process to produce a thermoplastic composite version using VICTREX AE™ 250 composites and VICTREX™ polyether ether ketone polymer.

The part is being produced using rapid manufacturing techniques that have reduced cycle time to minutes versus hours. An automated tape placement process produces the thermoplastic sheets tailored to meet the part’s requirements. The sheets are consolidated into laminates, press formed and machined into parts. Continuous fiber composite inserts are placed in an injection molding tool where a PEEK polymer is added. “This provides additional geometry and may functionalize that laminate in a way that cannot be done with composite material alone,” explains Jonathan Sourkes, TxV commercial manager.

The composite parts provide several advantages over the metal versions. They’re about 60% lighter, are faster to manufacture and don’t require the multiple milling steps needed for metal clips. Because there’s little waste, composite clips also have a much lower buy-to-fly ratio – the weight of the raw material divided by the finished component’s actual weight – than metal clips.

TxV started with semi-structural clips and brackets because the geometry is fairly simple and the isolated loads they carry aren’t flight critical. In addition, it’s easier to get small parts certified for aerospace use. But getting certification for clips or brackets is just a first step toward the goal of certification of larger, structural thermoplastic parts. “You have to find ways to get parts flying so you can demonstrate a track record of success in producing flightworthy parts and meeting application demands,” says Sourkes. At present, certification requires costly testing, but composites manufacturers are developing thermoplastic composite data for aerospace applications just as they are for automotive use. When new parts can be modeled, the need for physical testing will be reduced.

TxV creates digital twins of the parts it designs. “We have methods for parsing data and completing the analysis that get us to the point where we are comfortable that the part we will produce can be validated against those digital models,” says Sourkes. “We can analyze the digital models and be assured that our product is able to meet the qualifications and service requirements for the parts. It’s a much faster path to commercialization, and it allows the technology to proliferate.”

To reduce costs and cut the time between design and manufacture of thermoplastic composite components, designers are trying to get all the functional groups that will be working with a part involved at an early stage in the process, according to Sourkes. For example, looking at both performance and manufacturability at the initial stages will reduce the number of costly design and tool changes later. This can potentially take weeks, if not months or years, off the development process, he says.

Aerospace companies have additional reasons to take a closer look at thermoplastic composites, Sourkes adds. Because these components can be melted and reformed, airline companies may one day be able to recycle aircraft components that have reached their end of life.

Additional Applications

Although aerospace and automotive are leading the way in thermoplastic composites, other industries are discovering their potential. At the University of Alabama at Birmingham (UAB), Brian Pillay and his students have worked on thermoplastic composite projects for offshore drilling applications. One project involved the development of clamps to hold a new buoyancy system for deep water drills onto 350-plus drill strings, which are strong, heavy-walled pipes.

Having these parts made with composite materials was very important to the drill owner. “If for some reason the system failed, anything that was metallic would go down and damage the drill head, which costs tens of millions of dollars. It could also capsize the rig if the drill jammed,” explains Pillay. A composite piece, even if it fell, would not have that same impact.

Pillay initially tried to design the clamps with thermosets, but they couldn’t meet the project’s cost or strength requirements. With commercially available long-fiber nylon 66 glass and a nylon 66 thermoplastic resin, he and his students used extrusion compression molding to produce 750 thermoplastic composite clamps. Through extensive testing, these clamps proved they could meet every requirement.

Meanwhile, the thermoplastic composite nuts and bolts that a private company had made to hold the clamps in place didn’t fare as well and failed testing. Fortunately, the buoyancy project team, as a favor, had tested some thermoplastic nuts and bolts designed by one of Pillay’s PhD students. The hardware designed at UAB did meet requirements, so the team asked the university to produce 2,500 hardware sets in its full-scale prototyping lab. Those sets also performed well.

Clamped into place by thermoplastic composite parts, the buoyancy system was highly successful. “In fact, it did significantly better than they had anticipated, resulting in a $5 million savings for that exploratory drill operation,” Pillay adds.

The wind industry could be another market for thermoplastic composites. Giant wind blades are currently manufactured from cost-effective thermosets, but those blades are relatively brittle and tend to erode at the edges. With a thermoplastic leading edge on the blades, the industry could improve blade durability while retaining most of the economic advantages of thermosets.

Such examples are promising, but there are several technical and cost problems that need to be ironed out before there’s a smooth path to wider adoption of thermoplastic composites. The good news for now is that the thermoplastic composites industry is still in a pre-competitive phase. As people learn about the materials’ properties, most are willing to share what they know. While this period of cooperative research may not last, the information and insights gained will help encourage continued adoption of thermoplastic composite materials in aerospace, automotive and other industries.

SUBSCRIBE TO CM MAGAZINE

Composites Manufacturing Magazine is the official publication of the American Composites Manufacturers Association. Subscribe to get a free annual subscription to Composites Manufacturing Magazine and receive composites industry insights you can’t get anywhere else.