Smoother Sailing for Composites Supply Chain

Two years ago, composites companies were struggling with multiple issues when trying to obtain the supplies and equipment they needed to maintain their operations. Even when they could procure them, it was a time-consuming and expensive process to get them to the right site. While the composites supply chain today is in much better shape, problem areas persist.

From 2020 through much of 2022, material prices and freight costs were at record highs and lead times and transit schedules were long. “But the biggest fear was not getting material at all,” says Mike Wallenhorst, president of Fiber-Tech Industries and a member of ACMA’s Board of Directors. “At least now we feel confident we can get the materials and equipment we need.”

Quoted lead times are generally back to normal, but actual delivery dates can be unpredictable. For example, when Fiber-Tech needs to buy equipment and gets a quote with a three-month lead time, it’s not uncommon for the supplier to call a month later with a lengthy postponement of delivery.

“The delays are unexpected and so long as to be unbelievable. But it’s not across the board; it just pops up randomly,” says Wallenhorst, whose company manufactures GFRP panels. This is more likely to happen with more complex products like gel coats and equipment, which require more labor for production and/or must be imported.

Creative Composites Group, which manufactures structural FRP composites, had difficulty obtaining resins, pigments, catalysts and coatings during the COVID-19 pandemic and after the freeze in Texas in 2021.

“We had to deal with no confirmations for supply orders and dates being missed when orders were confirmed. In some cases, this resulted in short shipments or no shipments,” says Shane Weyant, chairman/CEO of Creative Composites Group and a member of ACMA’s Board of Directors. “Things have improved, however, and this is not the case currently.”

Managing for Volatility

Companies have developed several strategies for dealing with this supply chain uncertainty. During the worst of the supply chain woes, managers at each of Creative Composites Group’s locations met daily to discuss material shortages and juggle production schedules so they could continue manufacturing. Although there are fewer shortages today, managers still meet weekly to review what’s available and to ensure production can continue. The company has also identified a second supply source for all the materials it needs and has found ways to modify batch formulas to develop alternatives for certain hard-to-obtain additives.

Composites companies also are keeping a closer eye on materials and equipment inventory levels, trying to gauge how much they should stockpile given current conditions.

Fiber-Tech has gone through all its key equipment, identified any parts necessary to repair and maintain them and invested in a replacement parts inventory. “We knew that if something critical goes and we didn’t have [the right part] on the shelf, we could be down for months.” says Wallenhorst.

For materials like glass fiber, which have no shelf life, Fiber-Tech has adjusted its safety stock to cover almost every eventuality. Pre-pandemic it kept five loads of glass, during the pandemic it maintained 15 loads and the company has now cut back to eight loads in reserve.

“We’ve also asked our suppliers very tough questions about their forecasts and their supply positions and where we fall in their cadre of customers,” Wallenhorst adds. “We feel fairly confident that between our two suppliers and what they’ve committed to keeping in their warehouses we’ve got a good, comprehensive plan.”

A possible recession, which could reduce demand for composite products, must also be factored into the inventory equation. “For us, having what our customers need is paramount no matter the market conditions, and managing through the volatility of demand is a key focus. We need to make sure we are right-sized as far as inventory levels are concerned,” says Dave Smith, vice president of marketing at Composites One, a leading distributor of composites materials.

Weyant says composites companies need to develop close partnerships with suppliers and communicate with them frequently to ensure that they maintain the supply inventory that their customers need. He spent a lot of time during the pandemic talking and meeting with the people at supplier companies who made decisions about where they would send their materials.

Bringing Suppliers Closer

Transportation is currently one of the bright spots in the composites supply chain. The long, pandemic-related backups at both West and East Coast ports have disappeared, trucking rates have decreased from their record-high rates in 2022 and transit times within the U.S. are down.

But composites companies have not forgotten the difficulties they had obtaining overseas shipments during the pandemic. Some have made changes to obtain more supplies closer to home or at least in less politically volatile areas.

U.S.-imposed tariffs have already increased the cost of materials coming from China, says Wallenhorst. He fears that if relations between the two countries continue to deteriorate, China could decide to limit exports in certain industries. “If they do that in glass fiber, it would be devastating to the composites industry,” he adds.

Creative Composites Group had already begun distancing itself from China-based suppliers pre-pandemic. Today more than 95% of its materials supplies come from within the U.S.

Fiber-Tech, which annually requires almost 3 million square feet of polypropylene honeycomb cores, has taken a different route. With few North American suppliers, the company had to obtain most of its supply from China. But when the shipments arrived, the orders were often incorrect, and the specific honeycomb core sizes it needed didn’t fit into shipping containers. Fiber-Tech began analyzing the feasibility of opening a U.S.-based honeycomb production facility in late 2019.

“Then the pandemic came along and made things 10 times worse, which made us look like visionaries,” Wallenhorst says. Fiber-Tech ordered the necessary equipment for the facility in the fall of 2021, but due to supply chain issues didn’t receive it until this past winter. It now hopes to open the new production facility in June.

Ongoing Challenges

Although the composites supply chain is relatively stable now, the reality is that it could be disrupted at any time. During the last few years, weather-related incidents – from earthquakes and flooding to fires, hurricanes and deep freezes – have all impacted the U.S. and overseas supply chains. In addition, workforce shortages and labor problems at U.S. ports could impact material movement in 2023 and beyond.

Although the cost of oil has decreased since the first half of 2022, composites companies have not yet seen a hoped-for decline in pricing for resins, gel coats and other materials. Wallenhorst says one reason for this is chemical companies’ more granular approach to pricing. Petrochemicals no longer follow a single supply and demand equation. There are now individual companies with separate plants that follow their own supply and demand cycles.

Another factor in materials pricing is industry consolidation, with many former competitors in the materials supply market now owned by a few large corporations. That limits competition, which usually leads to higher prices and less supply chain resiliency.

Weyant says suppliers have told him that higher prices are necessary corrections that allow for capital expenditures to advance capacity improvements. Plus, both suppliers and transportation companies are passing on the costs of the higher wages they must pay to attract and retain good workers in a very tight labor market.

Although the composites industry is experiencing its own workforce shortage, composites manufacturers and suppliers that want to weather the ups and downs of their own supply chain must find the most qualified people they can to oversee it.

“It really boils down to investing in talented people and technology and partnering with great suppliers,” says Smith. “Those are the kinds of things that put companies in the right position to ensure that they've got the robust supply chain that they need to do business and get things done for their customers.”

Mary Lou Jay is a freelance writer based in Timonium, Md. Email comments to mljay@comcast.net.

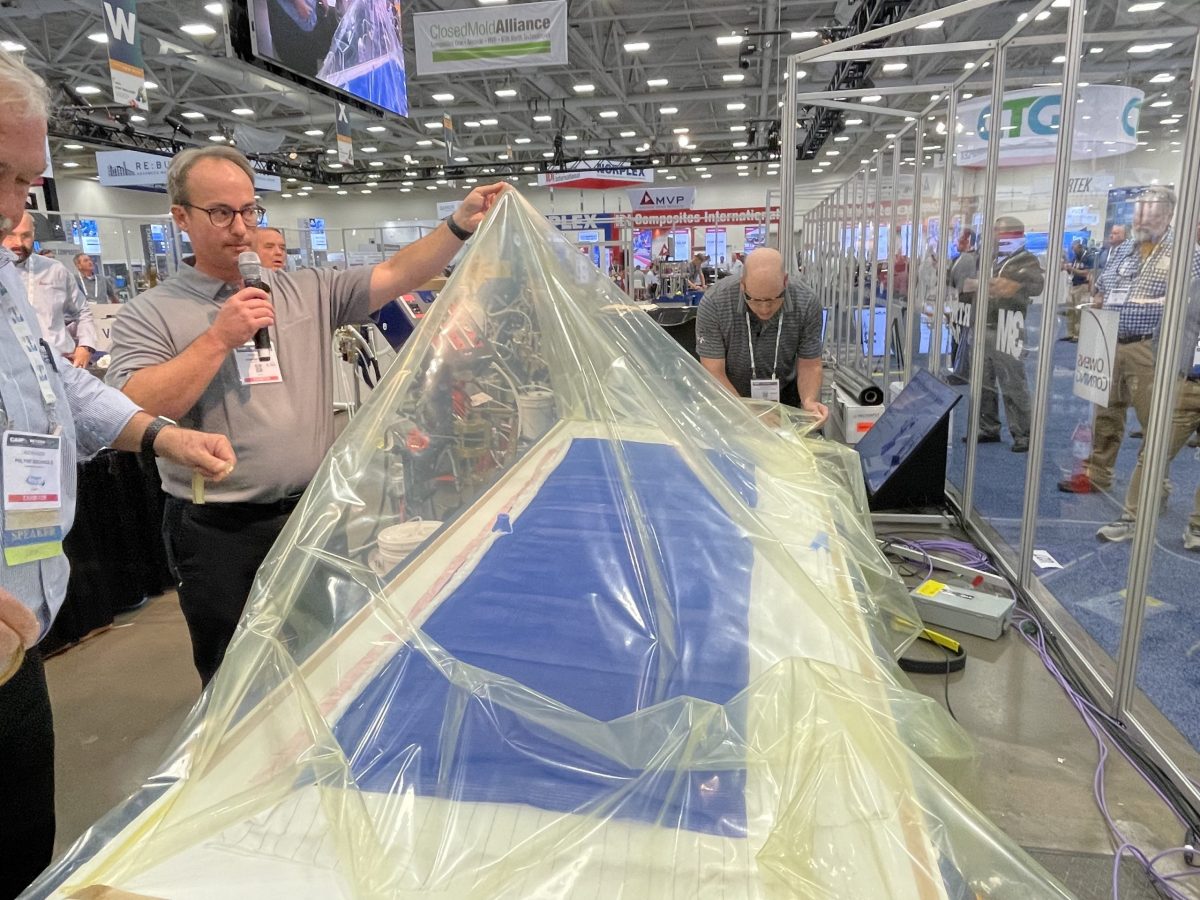

The smooth functioning of the composites supply chain is dependent upon the availability of qualified workers to handle the movement of goods and materials.

Photo Credit: Composites One

SUBSCRIBE TO CM MAGAZINE

Composites Manufacturing Magazine is the official publication of the American Composites Manufacturers Association. Subscribe to get a free annual subscription to Composites Manufacturing Magazine and receive composites industry insights you can’t get anywhere else.