Utilities Ready to Invest in FRP Solutions

Less than a decade ago, FRP composite utility pole manufacturers were going to utility companies to make the value case for installing their more expensive, yet significantly lighter weight products in difficult-to-access areas. Then came Hurricane Sandy in 2012, followed by Irma, Maria and Michael among other massive hurricanes and two years of record-setting wildfires in California. Suddenly there’s been an explosion in discussions about – and funding for – hardening the nation’s electric grid.

Today, the case has been made and utilities are turning to composite pole and crossarm manufacturers for solutions. “In the last two years, it’s like someone threw a switch. All of a sudden we can’t make enough of these poles,” says Galen Fecht, director of technical service and international sales for composite utility pole manufacturer RS Technologies Inc.

Withstanding Fire Tests

Perhaps nowhere has this trend been more dramatic than in response to the wildfires tearing through California. 2018 became the worst year on record for wildfires in the state, but a state climate change assessment predicts that by the end of this century the average burned area in California will increase by 77%. Wooden poles contribute to the problem when they snap under strong winds and live wires fall onto dry grass, providing sparks that ignite some of the most destructive fires. As utility companies face public scrutiny – and in some cases lawsuits – they are no longer standing idly by.

A couple years ago, California utilities began reaching out to FRP pole manufacturers in search of a solution that could better withstand wildfires. “Most composite poles and crossarms are inherently self-extinguishing, so they perform well in fires,” Fecht says.

There are other factors that set composite materials apart from traditional wood materials, too. “Fiberglass crossarms are stronger and more consistent than wood crossarms, resulting in less crossarm breakages and reduced likelihood of energized conductors dropping and starting fires in the first place,” says Michael Schoenoff, vice president of engineering for FRP crossarm manufacturer Geotek. “Additionally, the smooth surface of a fiberglass crossarm is less likely to build up with contaminants and is therefore less likely to lead to arc tracking.” Schoenoff notes that several utilities have reported a significant reduction in pole-top fires after switching to composite crossarms.

Eric Haddad, composite unit general manager for Valmont Industries, shares that PG&E, with support from San Diego Gas & Electric, sponsored a series of tests of FRP distribution poles in September 2019. Independent labs Southwest Research Institute and EDM organized a fire test, followed by a bend and break test to validate the structural integrity of the poles after fire.

The goal of these tests, says Dustin Troutman, director of market and product development for Creative Pultrusions Inc., has been to prove the survivability of FRP materials compared to traditional materials and construction, in terms of crown fires and brush fires. “Crown fires are when the fire travels across the top of the trees and then the brush fires are when it’s on the bottom,” he says.

Fecht elaborates that utility poles only have to withstand about two minutes of exposure to intense heat to pass this test. A brush fire, he adds, typically resides at a single location for about 30 seconds and for a crown fire in a heavily coniferous forest only 90 seconds.

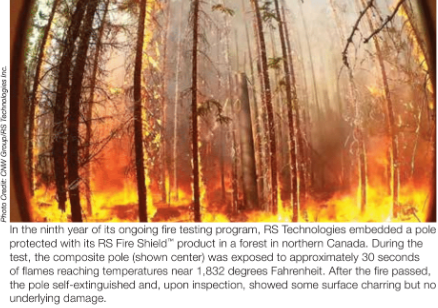

In 2011, RS Technologies began to undertake its own series of utility pole fire tests under the direction of a fire expert from the University of Alberta, so Fecht was familiar with the process. The initial full-scale test was designed to match the total heat flux (the amount of energy exposure) and flame conditions present in a two-minute fire, which is representative of a severe forest fire. “In following studies conducted with input and participation from California utilities, the testing time was increased to three minutes to represent an extreme fire event,” Fecht says.

Others have made formula adjustments to meet this growing demand. “We went through a lot of different iterations to finally get to the solution that we tested,” Haddad says. Without getting into proprietary detail, he explains that Valmont has added an intumescent material into its pole. “When the intumescent gets hit with the temperature of a fire, it will expand and protect the structural glass,” Haddad says.

The test results were a win for FRP overall. But composites manufacturers already knew their products would prove up to the test, and several are launching new facilities to support the explosion in demand for composite utilities products. For example, over the past five years, Geotek has made significant investments in its capacity and buildings, nearly doubling its manufacturing footprint to keep up with the demand.

Additionally, Valmont is opening its new crossarm and pole manufacturing facility in the second quarter of 2020. The plant will switch from fabricating its fire distribution poles with a centrifugal cast process to a filament wound process because the latter allows for increased throughput.

Understanding Deflection Limits

Haddad says this apples-to-apples style fire testing was eye-opening for utilities and pole fabricators alike. “We learned in this test that the requirements from the utility customers around deflection are actually more important than strength,” he says. “What they’re finding in wildfire areas is the fire either is accelerated because of the wind or it spreads a lot faster because of the high wind. They don’t want the pole really moving at those higher wind speeds.”

Traditionally, poles are specified on a required strength basis, and pole deflection has not necessarily been a focus of the initial structural analysis. Understanding the important role that deflection plays in utility structure performance, FRP pole manufacturers target certain deflection limits as their goal and inherently exceed the required strength requirements expected.

“A lot of people are under the misunderstanding that composite poles deflect more than wood poles,” Fecht adds. “Although composite materials can have a lower stiffness ratio on a strength equivalent basis, composite manufacturers understand that their products must have comparable deflection performance under load when being installed alongside traditional wood poles, and they design accordingly to achieve this. This is why deflection, and not strength, is typically the governing design characteristic for utilities seeking wood pole equivalency.” And that’s one reason fabricators are encouraging shifts in how utility structures are specified.

As Fecht explains, utility customers typically look for engineered poles to provide “wood pole equivalent” performance. If a utility typically uses an ANSI-designated 50-foot Class 1 wood utility pole, that’s what they would request from a composite pole manufacturer. But Fecht’s response is that what the utility is requesting is a solution as strong as a 50-foot Class 1 wood pole that also deflects in the same range as that specific length and class wood pole. As a result, the term ‘serviceability equivalency’ has emerged to capture both the initial strength requirement and the required deflection performance and is the recommended design approach to use when designing comparable/compatible FRP poles, says Fecht.

“Where it gets interesting is a lot of people don’t understand deflection even on wood poles,” Fecht says. The flex in a wood pole will vary depending on its length and class and also the specific species of wood utilized. Southern yellow pine, western red cedar and Douglas fir, for example, each have a different modulus of elasticity, resulting in different deflection performance. However, reported deflection values for wood poles represent a mean value rather than an absolute, and some in the industry have used these mean wood pole values as absolute value for composite pole deflection. This practice inadvertently results in a stiffer than required, unnecessarily more expensive composite pole to be specified when serviceability equivalency was the initial goal.

The recently released second edition of the American Society of Civil Engineers’ Manual of Practice (MOP) 104, Recommended Practice for Fiber-Reinforced Polymer Products for Overhead Utility Line Structures, addresses this. “The section on deflection, Section 3.10.8 Deflection Serviceability Equivalency, where the term serviceability equivalency has been established in the utility lexicon, has been introduced to more clearly address this specific design approach,” Fecht says.

An added benefit of using FRP over wood is that the composite pole will achieve the specific deflection requirement more consistently than wood. As Amol Vaidya, senior global innovation leader with Owens Corning, explains, “We are able to tailor the performance of those products to meet customer needs.”

Vaidya offers an example: “If the customer is looking for higher shear performance, that is typically driven by what we put on the glass in terms of chemistry [glass sizing]. This size drives the compatibility with the resin and can be customized.”

Lately, Vaidya has seen a trend toward reinforcements beyond typical ECR glass fibers to adjust the modulus of elasticity of composites. “Here, pultruded sections reinforced by high-modulus glass fibers or fabric composites enable a step change for composites performances,” he says.

In addition, polyurethane-based resin systems are emerging as a popular resin choice alongside polyester and vinyl ester resin systems. “We’re seeing this resin being used because of the benefits that material offers in terms of damage resistance as compared to other types of systems, including polyester and vinyl ester,” Vaidya says.

Ultimately, Haddad predicts, closer collaboration with the client could simplify the specification process for FRP utility poles. Currently, a specification may just note an ANSI-required pole tip circumference that’s largely irrelevant for FRP poles. “We’re hoping [in the future] they give us a groundline requirement and a deflection requirement in terms of inches per thousand pounds so that it’s truly an apples-to-apples comparison among the competitors that make composites distribution poles,” Haddad says.

Hurricane Grid Hardening

Of course, fires aren’t the only disaster that have led utility companies to consider grid hardening. In 2005, Hurricane Wilma damaged about 12,000 utility poles across Florida. Utilities in the state began moving some lines underground and switching to composite and concrete poles. Even so, more grid hardening is required as 2018’s Category 5 Hurricane Michael took out more than 6,800 utility poles in the Florida panhandle.

There’s ample evidence that FRP poles can stand up to high winds. RS Technologies installed about 500 poles in a 69kV transmission line in the Bahamas a decade ago. “That line took a direct hit from Category 4 Hurricane Matthew in 2016,” Fecht says. While Grand Bahama lost several thousand wood poles to the 140 mph winds, there was no damage to the composite structures, which were designed to withstand 150 mph winds.

Last year, RS Technologies was called in for a new project to support the island’s grid resiliency. The fabricator provided a small line of poles to connect a new solar farm and battery depot to Grand Bahama Power’s main substation. Shortly after completing that project, Hurricane Dorian devastated the island. Not only did the new project withstand the sustained 160 mph winds, but so did the initial 500-pole line.

Today, RS Technologies is replacing nearly 9,000 poles in the U.S. Virgin Islands. “FEMA came in and said if we’re going to rebuild, it’s going to have to be different than wood because we keep replacing wood poles that have failed in hurricanes,” Fecht says.

Installation Cost Case

FRP poles remain popular in areas where their benefits have already been proven. “There’s always going to be that need for limited access areas and woodpecker-prone areas where utilities want to be proactive and put composites in,” Troutman points out.

What is changing in those areas, however, is that utilities are now less likely to balk at the higher upfront cost of FRP poles. They’ve already seen the healthy return on investment in composite poles and crossarms.

“There are a number of utilities we work with that, as soon as they have a woodpecker hole, that pole comes out and a composite pole goes in,” Fecht says. The reason? Installing a $500 wood distribution pole might ultimately cost closer to $13,000. That includes higher costs for equipment to install wood poles, plus future maintenance costs of sending out crews to inspect and patch woodpecker holes at easily $1,000 per hole. And because the conductor-induced vibration of a wood utility pole suggests to woodpeckers that there’s insect activity inside the pole, one hole quickly leads to dozens more. Those costs rise fast.

The case for return on investment is also being made in difficult-to-access instances. Fecht cites an example of an installation in Australia where the utility had planned to build an $80,000 road to move heavy equipment in and replace a single wood utility pole. “You can rent a helicopter for a day for a lot less than $80,000,” Fecht says. While it may seem counterintuitive, the ability to transfer lightweight composite products by helicopter has demonstrated tremendous cost savings.

An installation of 140 H-frame structures for a Scottish and Southern Electricity Networks wind farm transmission line connection in northern Scotland also demonstrated how helicopters could lead to savings. The installation of these 90-foot FRP structures took only three days, with a cost of $16,500 per hour of helicopter use. It’s a tough number to swallow, until calculating the cost of months of transporting massive wood structures across the difficult terrain. In addition, the line was completed well ahead of schedule, allowing the line to be energized and deliver revenue sooner.

Crossarms have also helped make the cost case for FRP transmission and distribution structures. “A majority of utilities have now adopted composite crossarms in place of wood,” Schoenoff says. “They get significant grid hardening benefits in addition to a much lower total ownership cost due to the improved service life of fiberglass crossarms.”

“There’s probably more of a turn across the nation away from wood and toward FRP crossarms than has been seen in the last 20 years,” agrees Jim Bob Wiles, senior manager, Valmont Composite Structures. “I dare say that in 10 years wood will be in lower usage compared to fiberglass.”

As Wiles points out, crossarms have now had over a decade to prove their cost benefit: “FRP crossarms were introduced in 1992, and it takes 20 to 25 years before utilities believe that it really works. That’s where we are now.”

New Competitors

With composite products suddenly becoming mainstream for utilities, long-time FRP crossarm and pole manufacturers are finding the market is filling up with a new competitor — first-time FRP manufacturers. Long used to defending their product against steel and wood, the experienced manufacturers are now educating end users on exactly what makes a reliable product.

“Across the whole composites industry, whenever there’s a market that sees a bubble – and that goes from bathtubs to boats – we get people coming in that don’t do such a good job,” Wiles says. “It muddies the water, and that’s why fiberglass composites, frankly, get a bad name.”

As Fecht points out, when a utility specifies a wood pole, they can go to lots of suppliers and get virtually the same product. “They might have some subtle differences in how they treat them, but those poles all come from the forest,” he says. “But with composite materials, when you ask for that 50-foot Class 1 pole, you can get that from any number of manufacturers who use different manufacturing methods, different raw material inputs, including different resin systems, and you can end up with very different products under the same broader category and a resulting range of performance across many dimensions.”

Fecht works to educate end users on factors that can undermine an FRP pole’s durability, such as insufficient UV protection that could lead to structural deficiencies due to resin loss from fiber blooming. Meanwhile, manufacturers across the board continue to adjust formulas to further strengthen their products. “There’s been a focus now for several years on increasing the reliability,” Troutman says.

The case has already been made that FRP might be the right solution for more jobs than previously imagined. As Fecht puts it, “Ten or 15 years ago we were saying, the pole can do all these great things and utilities were looking at it and looking at the price and saying, ‘Sure, but give us some examples.’ Now with installations on all five continents, we can say, ‘What about this in the Bahamas and this in Scotland and this in Norway and this in California?’”

SUBSCRIBE TO CM MAGAZINE

Composites Manufacturing Magazine is the official publication of the American Composites Manufacturers Association. Subscribe to get a free annual subscription to Composites Manufacturing Magazine and receive composites industry insights you can’t get anywhere else.